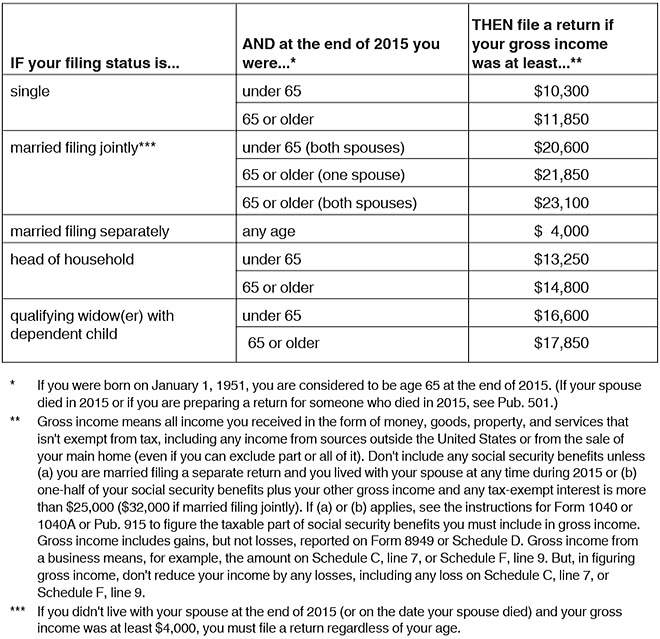

You are required to file a federal income tax return if your income is above a certain level. That level varies quite a bit, depending on your filing status, your age and the kind of income you’re reporting. See the table below to see where your situation falls.

Sometimes, File Anyway

There are some cases where it’s advisable to e-file a tax return anyway, even if you aren’t required to. First, if you had federal income tax withheld from your pay, or if you made estimated tax payments, you should file in order to get any surplus withholding refunded back to you.

Second, there are a few tax credits that can give you a refund even if you didn’t make enough income to file. These are called “refundable” credits, because they can give you a refund. Nonrefundable credits can only apply against taxes you owe.

- Earned Income Tax Credit – You could qualify for the EITC if you worked but didn’t earn a lot of money. Your credit amount will depend on income level, filing status and how many dependents you claim.

- Additional Child Tax Credit – This credit could be available if you have at least one qualifying child and you didn’t receive the full amount from the Child Tax Credit.

- American Opportunity Credit – The maximum credit for this education credit per student is $2,500 for the first four years of postsecondary education. Up to $1,000 of the credit can be refundable.

With these credits, you have to file in order to qualify.

Filing Rules for Seniors

Are your Social Security benefits taxable? That depends on your other income and benefits for the tax year. Social Security benefits include monthly retirement, survivor and disability benefits. They don’t include any supplemental security income (SSI) payments, which are not taxable.

As a very general rule of thumb, if your only income is from Social Security benefits, they won’t be taxable, and you don’t need to file a return. But if you have income from other sources as well, there may be taxes on the total amount.

To find if your benefits may be taxable, start with what’s called the base amount for your filing status, which is:

- $25,000 if you are single, head of household, or a qualifying widow(er)

- $25,000 if you are married filing separately and lived apart from your spouse for the entire year

- $32,000 if you are married filing jointly

- $0 if you are married filing separately and live with your spouse at any time during the tax year.

To find out whether your Social Security benefits are taxable, divide your total Social Security benefit amount by 2, then add all your other income (including any tax-exempt interest). Compare the result to the base amount for your filing status. If your result is higher than the base amount for your filing status, you’ll probably be taxed on the total.

If you’re married and file a joint return, both spouses must combine their incomes and Social Security benefits when figuring taxable amounts. This applies even if the spouse did not have any benefits.

The IRS offers this worksheet to calculate taxable benefits: